Data APIs

The pipelines for transferring and accessing normalised bank data, from your customer's bank account into any platform.

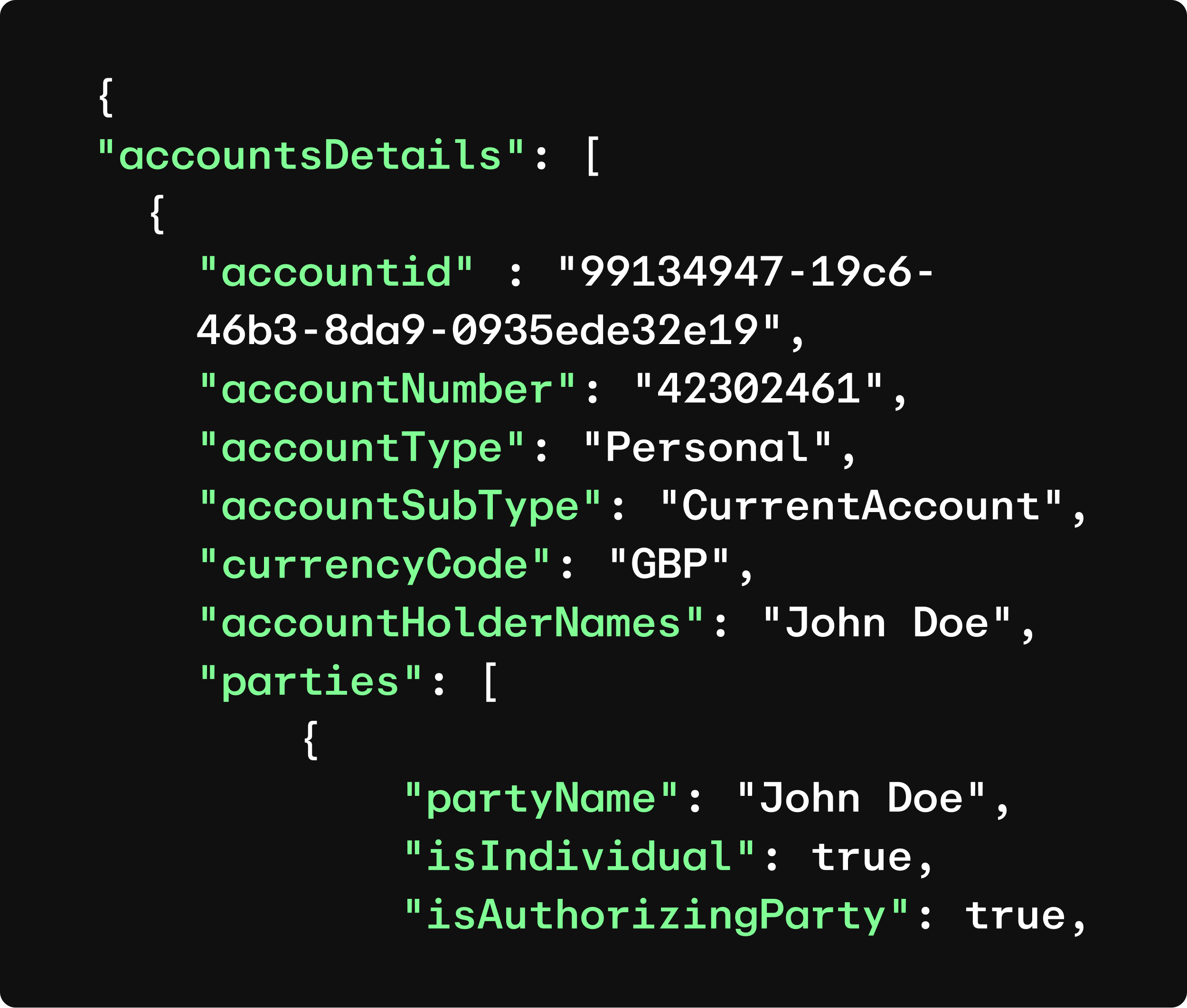

Real-time, normalised data

Our unified Data APIs transfer account holder information and transaction data from your customer’s bank, to you.

No matter where your data comes from, our Data API normalises and enriches the data we receive from financial institutions, saving you time and effort spent building and maintaining multiple integrations.

Better quality data. Better quality portfolio.

Lenders choose Atto to fill the gaps in their traditional prediction models; to bring colour to data that was black and white.

Enriched data

Within seconds of a consent you can view account holder name, their account type, alongside balances and enriched transactions.

Secure

Open API's are highly regulated and secure. Our APIs are built on bank grade security that are compliant with the UK FCA and international standards.

13,000+ banks

Our data APIs provide a normalised single point of integration that supports over 13,000+ bank connections in over 45+ countries.

Stored data

When a customer consents to share their data, we can store the received data for you, you can also decide when to refresh or delete data.

Accurate data

Open banking data comes directly from banks and financial institutions. The data is real-time, accurate, and impactful when making credit & risk decisions.

Categories & classes

Our enrichment process categorises data into over 80 categories and 11 classes so you can understand how and where your customer spends their money.

Better informed decisions across the credit risk lifecycle

Credit risk decisioning

Understand customer affordability and creditworthiness in real-time.

Risk modelling

Enhance predictive models with real-time open banking data for a significant uplift in performance.

Atto insights

Understand how your customer’s spend, save and earn their money with real-time insights.